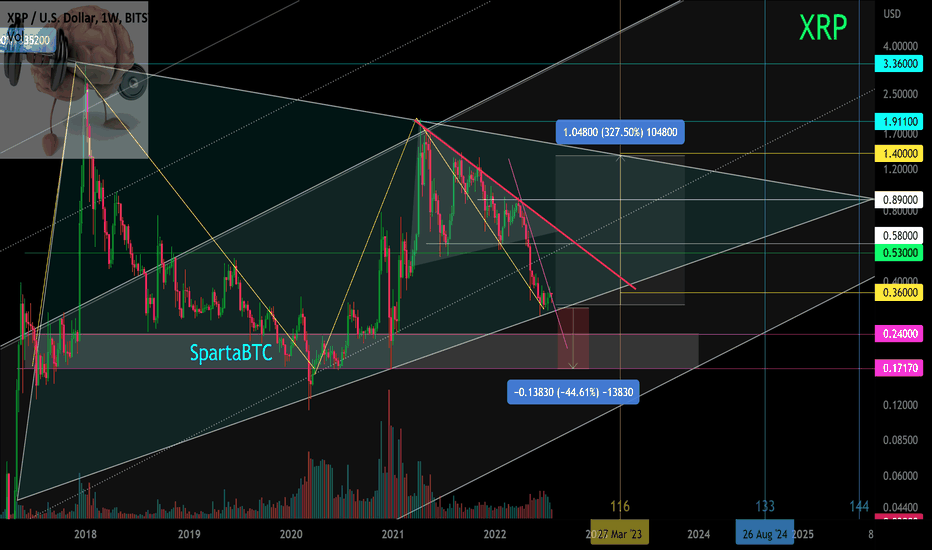

XRP/USD Main Trend Analysis: Unveiling the Triangle Pattern

-

Main trend analysis for XRP on a logarithmic chart with a 1-week timeframe shows consolidation within a triangle zone. When viewed on a line chart with the same parameters, a similar pattern emerges. Zooming out to a 1-month timeframe provides a broader perspective on the overall main trend for XRP/USD.

-

The crypto market could see major movements on June 9, 2023.

-

Local job opportunities are currently on the rise within the ascending channel, with a focus on percentages and reversal zones.

-

Ripple shows strong local momentum as it breaks out of the descending channel on February 28, 2024. There is a potential channel range forming, indicating consistency with previous patterns. No significant new developments have emerged at this time.

-

XRP / BTC price update on March 15, 2024.

-

As evident, there has been a significant public relations push surrounding "hamster entertainment" within this sphere for several years. The excitement peaked when this particular cryptocurrency gained traction, recognition, and surged by an impressive +51,900%. The XRP community, undeterred by skepticism, remains one of the largest in the crypto industry. This fervor can be attributed to the allure of substantial profits and the air of mystery surrounding the token itself. There exists a network of storytellers, predominantly in the English-speaking realm, perpetuating this narrative as money flows in that direction. While not all participants are acting deliberately, many are swept up in confusion, mistaking wishful thinking for reality. Nonetheless, their vast following contributes to the proliferation of this speculative mindset. Some individuals, firmly entrenched in this belief, anticipate a sudden spike in the XRP token's value to $589 per unit. This misguided optimism could transform those who consider themselves destitute into instant millionaires.

-

People are often drawn to deception and eagerly embrace inflated promises, even if it means being misled. Witnessing a token's price surge by a typical 50-100% is seen as a major victory, fueling a sense of validation and self-assurance. Past discrepancies are conveniently forgotten by loyal followers, who remain fixated on the allure of quick gains. Meanwhile, alternative investment avenues with similar liquidity potential often yield significantly higher returns, yet these opportunities are overlooked. This phenomenon highlights a perplexing aspect of human psychology, where individuals immerse themselves in illusions of grandeur, refusing to acknowledge their own gullibility. Ensnared in a cycle of wishful thinking, they cling to unrealistic expectations, allowing savvy market players to capitalize on their naivety. Manipulative tactics, coupled with a relentless stream of sensationalized news, contribute to this cycle of exploitation.

-

This phenomenon is prevalent across all markets, but it is particularly pronounced in the cryptocurrency space. There is a pattern of significant surges in the valuation of centralized platforms like Ripple, which offer rapid and conditional transaction capabilities that are not truly blockchain-based. This trend is set to repeat, as evidenced by Ripple's deliberate distancing from the speculative XRP token back in 2018, which has been reflected in platforms like coinmarketcap and related project sites. It is essential to recognize the evolution of Ripple from its initial project incarnation under a different name, preceding the emergence of Bitcoin and the enigmatic figure of its purported creator, Satoshi Nakamoto.

-

It's important to highlight that the individuals involved in XRP, the MtGox exchange core creators (Jed McCaleb and team), and customers are interconnected. For those unfamiliar with the situation, the MtGox exchange from 2010 to 2014, initially intended for resale to a French buyer, turned out to be a significant scam that manipulated and retrieved a large portion of users' bitcoins. Subsequently, BitFinex emerged in 2013, with some of its initial investors being former MtGox traders who were affected by the scam. Security vulnerabilities were exploited for two years, enabling the exchange's core creators to siphon off bitcoins until the breach was made public, revealing the MtGox scam. A similar scenario unfolded with FTX, involving exchange core manipulation and theft by insiders. Notably, 650,000 BTC were stolen by purported "hackers."

-

BitFinex's direct connection to the popular stablecoin Tether USDt is a noteworthy point to consider. The issuance of money in any form globally is primarily controlled by a single entity and its affiliates, albeit with a degree of separation from the original source. The rise of USDT has significantly impacted the market by facilitating market expansion and the introduction of derivatives trading pairs. The emergence of the "decentralized" USDT has played a pivotal role in enhancing market growth and liquidity. When exploring the implications for XRP and the broader banking landscape's shift towards digitalization, it is crucial to understand the interconnectedness and anticipate future developments.

-

The elite individuals of both traditional and emerging wealth have always been driven by self-serving ambitions. They do not simply earn money; they possess the ability to manifest wealth out of thin air based on their desires and necessities. As a result, their mindset differs significantly from that of the average market participant. They operate within their own realm, establishing and dictating the rules and parameters of engagement. Instead of focusing on earning profits, their primary objective is to assert control and wield power while maintaining a strategic vision for the future. It is now the time to play their game by their rules, exchanging resources to attain desired outcomes. Throughout history, these individuals have mastered the art of manipulation by setting cunning traps and exploiting the predictable behaviors of the masses within their domain of influence. Why should one believe that future circumstances will deviate from this pattern? Numerous instances of deceptive practices within the realm of cryptocurrency speculation serve as poignant reminders of how individuals willingly fall into these traps, only to later rationalize the actions of those who deceive them as if they were virtuous figures.

-

How can market conditions be established to trigger stock exchange rule #589? Rule #589 is frequently referenced by various individuals in English-speaking tweets. Let's take XRP as a relevant and plausible example. Forced verification within XRPL is crucial, where balances can be frozen for XRP holders who haven't undergone verification, marking their funds as potentially "dirty" and subject to blacklisting. Trading halts on most exchanges aim to prevent dumping and eliminate problematic tokens, with refunds provided at the purchase price before trading resumes at a significantly higher level. Trading is limited to verified users on select exchanges, resulting in a surge in prices due to limited selling. Delays in verifying large addresses and quick verifications for small addresses contribute to a tight supply, causing prices to skyrocket. This scarcity benefits only the scammers and their associates, who can sell XRP at inflated prices on specific exchanges while keeping other holders sidelined. Only a few "approved" exchanges permit XRP transactions for verified users, leaving long-term holders unable to capitalize on price surges. Scammers exploit this situation, attributing the market dynamics to unforeseen circumstances while preying on gullible individuals.

-

Always establish achievable goals rather than focusing solely on what you desire. Currently, significant capital from the Bitcoin market is flowing into XRP, raising the likelihood of a notable price surge in April.

-

The price has recently hit the level of 0.6951 and has since retraced back to the local breakout zone. It is currently positioned at the midpoint of a long-term ascending channel-accumulation, within the clamping zone of a significant symmetrical triangle spanning from 2017 to 2024. The chart depicts the percentage levels within this zone for the local-medium term analysis.

-

As an experienced SEO-focused writer specializing in English and cryptocurrency news, I will rewrite the existing comment while ensuring it aligns with proper SEO guidelines.

-

Part of the main trend is characterized by a large triangle, with this channel leading up to the denouement. The chart displays the major long-term trend reversal zones and their respective percentages, indicating our current position within that zone. An important factor not depicted here is the takeout percentage, which serves as a probability to consider based on past events like BTC's -68% takeout during the "crown dump" in 2020. For instance, in early 2017, XRP experienced a significant dump of over 65,000% - 55,000%, largely due to low liquidity. I have previously discussed the potential risks of deception at reversal zones and provided strategies for both protection and profit in such scenarios.

-

Trade successfully closed as the target was reached after a breakout of the 0.5902 price point, leading to a price drop to the 0.4496-0.4929 zone, representing a -20% decrease (slipping to 0.4188). Currently, the price is consolidating in a local triangle formation at the support level of a significant accumulation channel post retracement. A potential breakout above 0.5199 could signal an exit with a local target around the channel’s midline. Conversely, a bearish market could confirm a descending pennant pattern. Key pivot zones and liquidity levels remain unchanged, with detailed percentage movements highlighted.

-

Trade in progress