The market outlook

The market fell further as we expected last week. During the economic data window, the market began to price in only one interest rate cut this year. This is not just for the crypto market but for all financial markets. This situation is likely to last until early July before bulls come back and bring enthusiasm again. During this period, the PCE released this Friday will bring about a small rebound.

BTC ETFs and market sentiment

In addition, multiple BTC ETFs have experienced net outflows for several consecutive days, which is also a microcosm of the US market sentiment. After some asset management companies submitted S-1 documents for the ETH ETF, the market expected that the ETH ETF would be officially listed in early July, which would also bring about a small-level rebound.

Long-term trend

Regardless, we are on the way to a rate cut, and the long-term trend for all types of financial assets must be upward.

ETH performance and indicators

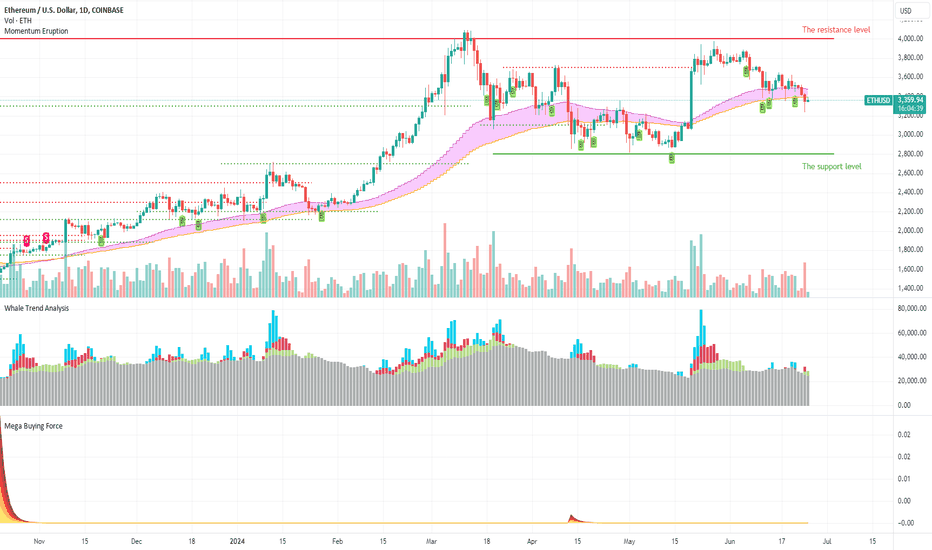

ETH fell less than BTC. This may be related to the upcoming listing of ETF ETH. Yesterday's decline saw significant trading volume, but eventually, a pin-bar formed. For ETH, the MBF indicator does not indicate bottom-buying sentiment. There is no obvious blue column representing whales on the TSB indicator. The ME indicator continues to maintain a bullish trend, but the wavy area gradually narrows.

Conclusion for the week

To sum up, we believe that ETH is likely to remain fluctuating this week. We maintain our original resistance level at 4000 and support level at 2800.

Disclaimer

Nothing in the script constitutes investment advice. The script objectively expounded the market situation and should not be construed as an offer to sell or an invitation to buy any cryptocurrencies. Any decisions made based on the information contained in the script are your sole responsibility. Any investments made or to be made shall be with your independent analyses based on your financial situation and objectives.