Bitcoin and US Stocks Rebound

After the CPI data released by the Labor Department last week showed that inflationary pressures further eased in May, BTC and US stocks rebounded significantly, covering the decline caused by the previous employment data.

FOMC Announcement

However, in the subsequent FOMC, the dot plot showed that the median number of interest rate cuts this year was one, which was lower than the market expectation of two. And at a later press conference, Powell said that inflation had further eased, but was still higher than planned. This takes into account the CPI. The markets fell on the news.

Crypto Market Trends

High market sentiment was cooled. In the next half month, crypto continued to fall as the main trend, and during this period, there may be a rebound due to the listing of the ETH ETF. The trend will maintain until economic data of June is released.

ETH Performance

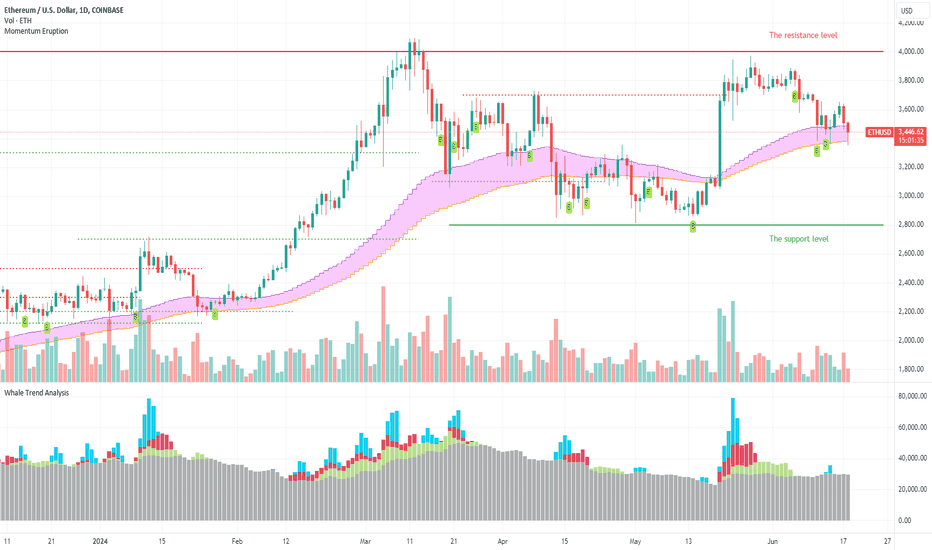

While ETH bulls resisted over the weekend, on Monday, it gave back its gains on the weekend. From the WTA indicator, you can see that almost no blue columns appear, unlike BTC. This shows that whales are more inclined to BTC. However, in terms of trading volume, ETH has not decreased significantly, and retail investors still choose ETH.

Short-Term Outlook for ETH

In summary, we believe that ETH will continue to correct in the short term. However, if the ETH ETF is officially launched, it will slightly encourage the market and rebound. We maintain our original resistance level of 4000 and support level of 2800.

Disclaimer

Nothing in the script constitutes investment advice. The script objectively expounded the market situation and should not be construed as an offer to sell or an invitation to buy any cryptocurrencies.

Any decisions made based on the information contained in the script are your sole responsibility. Any investments made or to be made shall be with your independent analyses based on your financial situation and objectives.