Unveiling the Power of Bull Flag and Bull Contraction in Cryptocurrency Trading

-

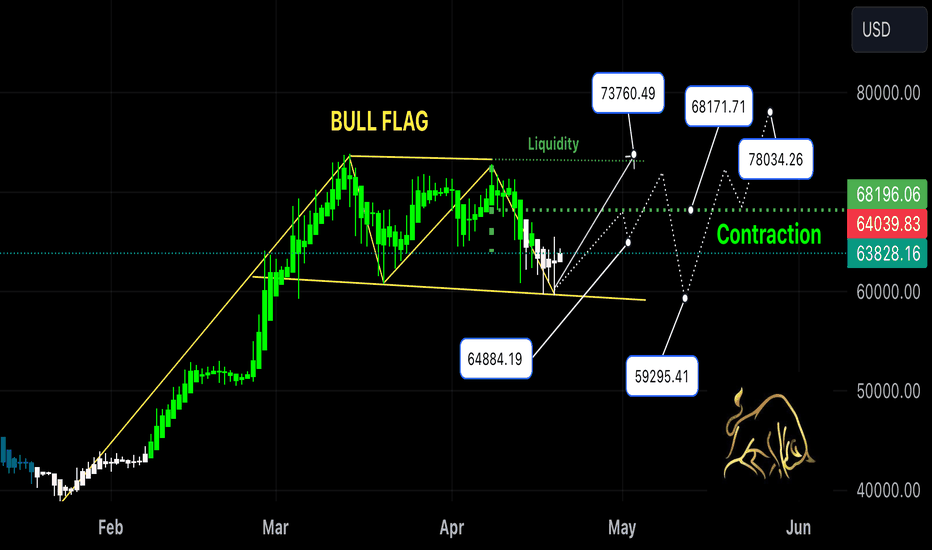

This is a bullish whale contraction, with whales potentially forming a bull flag within it. The first step is for the price to approach the value line to ascertain the intentions of smart money. Make sure to identify the key levels and mark the liquidity zones accordingly.

-

Let’s explore the impact of the upcoming halving on Bitcoin. Many predict a significant price shift, with contrasting views on whether it will rise or fall. The current bullish trend above $63k indicates potential for a price increase driven by strategic whale activity. As the number of mined blocks surpasses 834,327, speculations arise about the halving's effects on market dynamics. While historical data suggests a surge post-halving, the current market conditions, such as regulatory approvals and macroeconomic factors, may lead to increased price volatility and potential disputes within the crypto ecosystem. The US Federal Reserve's evolving monetary policy and global economic uncertainties further contribute to the uncertainty surrounding Bitcoin's future price movements.

-

BTC halving is a topic that sparks varied opinions, with some predicting an increase and others anticipating a decrease. Personally, I remain skeptical of news and analyst forecasts, as past experiences have shown unexpected outcomes. Despite warnings of a crash following previous halving events, Bitcoin not only recovered but thrived, even amidst rising federal rates. While significant price drops may occur, I am hesitant to foresee a major crash in the near future. I firmly believe that we should exercise patience and avoid premature conclusions. The direction of Bitcoin's value rests in the hands of whales rather than the general public, news sources, or analysts. Therefore, I rely on thorough research of smart money movements rather than mainstream opinions or the impact of halving events. Although many are adjusting their technical analysis strategies due to the halving, I maintain my usual approach. If you hold a different view, I suggest waiting to see how events unfold rather than engaging in debates prematurely. Ultimately, the decisions of wealthy whales, not individual investors, will dictate the market's trajectory. I remain cautious of potential tactics employed by whales to mislead us and have taken precautions by conducting extensive research.

-

I have identified a head and shoulders pattern that has already played out, indicating a significant upward movement. Additionally, there is a double top formation that has already experienced a decline. I plan to share my analysis shortly, as I am currently pressed for time.

-

Still patiently anticipating the bullish movement with corrections ongoing since last night.

-

I am eager to spot a potential head and shoulders pattern that has completed its formation, indicating a potential significant upward momentum, accompanied by a double top formation that has already experienced a downward correction. I identified this pattern using my volume indicator, revealing hidden insights into institutional investor activities. This setup may play out in the next hour, possibly leading to a bullish rally.

-

Get ready for an exciting ride!

-

The whales have strategically orchestrated this scheme for a long time, showcasing their affinity for reverse psychology tactics.

-

My previous predictions may have fallen short, despite having strong indicators for bullish trends. Unfortunately, market manipulation by whales led to the misconception that the halving would cause a significant drop in prices. It's disheartening to see yet another instance of news manipulation in the industry. Although some traders anticipated Bitcoin price increases, these projections also did not come to fruition. It's important to acknowledge that everyone involved in the market does their due diligence and analysis.

-

SPINNING TOP WHITE 15-HOUR TF that has closed, signaling BULL POWER.

-

SPINNING TOP WHITE spotted on a 22-hour time frame - a rare occurrence since April 18th. Miners aimed to lower it, while retail investors waited, and then WHALES initiated a bullish price action candlestick. This surge happened due to bullish contraction by whales, surpassing $68k.

-

4-hour timeframe is about to expire, with the daily timeframe up next, signaling a significant movement ahead. This pending development has been lingering for several days now.

-

4-hour timeframe has once again gained strength and appears poised for a slight uptrend.

-

Closed bullish engulfing pattern spotted on a 6-hour time frame.

-

BE is poised for a significant uptrend, particularly given its current position on a 6-hour time frame (TF).

-

The Earth Boys may be anticipating a dip in the market, but it seems like the celebration might have to wait as the market isn't dipping just yet.