Unveiling Ethereum’s Surge: Crucial Levels and Catalysts

ETHUSD

Key Technical Observations:

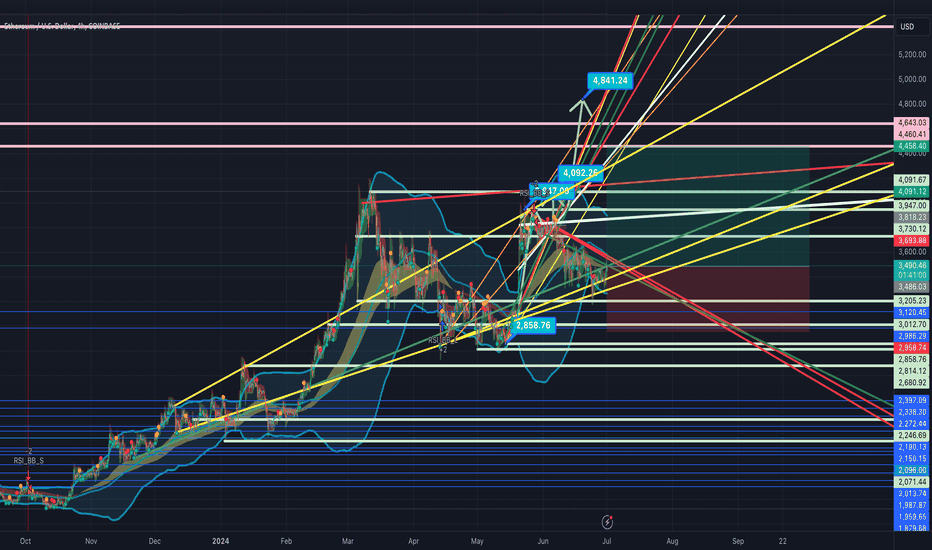

1. Descending Channel Breakout: Ethereum is challenging a significant resistance at $4,250, indicated by recent price actions. Overcoming this level could set the stage for a bullish push towards $4,000 and higher.

2. Staking and Supply Dynamics: A substantial increase in ETH staking has been observed, signaling a strong bullish sentiment and a potential decrease in market supply. This could further fuel the upward movement if the resistance is breached.

Market Catalysts:

Ethereum Network Upgrade: The upcoming Dencun upgrade is poised to enhance transaction efficiency, potentially increasing Ethereum’s attractiveness to developers and investors.

Anticipation Around Ethereum ETFs: Market excitement builds as the potential listing of Ethereum ETFs could draw significant capital inflows, driving up ETH prices.

Strategy Going Forward:

Long Position: Consider a long position if ETH price sustains above the $4,250 resistance, with a target of $4,500. Set stop losses strategically below $4,000 to mitigate risks.

Keep Updated: Stay alert to any announcements related to the ETFs and network upgrades, as these could dramatically influence Ethereum’s price movements.

Conclusion:

Ethereum shows promising signs of a strong upward trend. With key market developments on the horizon, now is a crucial time for traders to watch for breakthroughs at critical resistance levels.

Chart Analysis:

The attached chart highlights these insights, showcasing Ethereum’s potential paths and critical levels. Keep this chart handy as a visual guide for your trading decisions.