Tether’s Reserve Program: A Game-Changer for Bitcoin’s Future

Tether to Use 15% of Net Profit to Buy Bitcoin

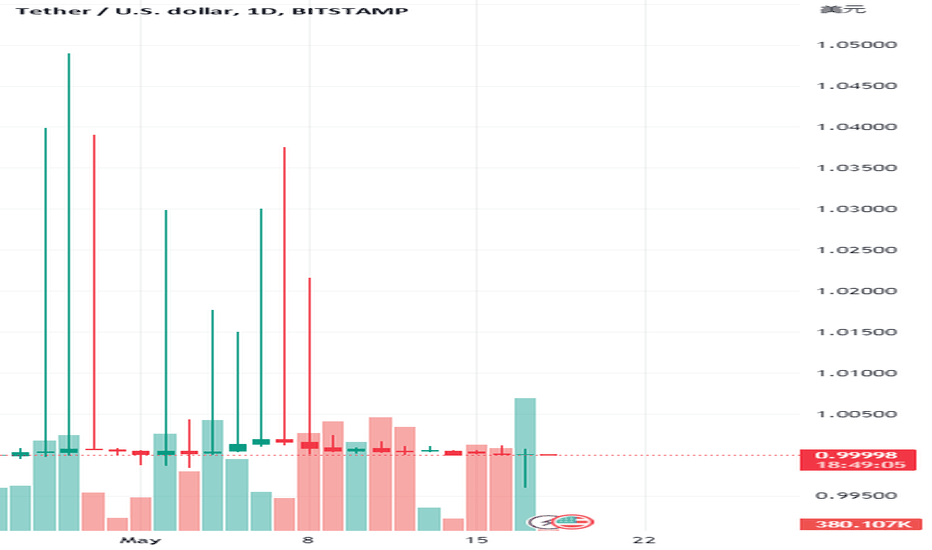

According to Tether's official tweet, the new reserve plan indicates that Tether will regularly use 15% of its net profits to purchase bitcoin, which is also part of Tether's reserve assets:

Starting this month, Tether will periodically allocate up to 15% of its net realized revenue to bitcoin purchases. These bitcoins should be viewed as 100% backing Tether's minimum reserve assets.

If we take Tether's first quarter net profits of $1.48 billion, that would cost the company about $220 million to purchase bitcoin.

Tether to Self-Custody Bitcoin

Tether's blog details the intent of the program, which aims to ensure a stable peg of USDT to the US dollar through a diversified reserve approach. At the same time, Tether has made it clear that it will not choose to have its bitcoin assets hosted by a third party:

While third-party custody of bitcoin is a common method for many institutional investors, Tether believes in "not your keys, not your bitcoins" and therefore maintains its own private keys associated with bitcoin assets.

Tether's Chief Technology Officer, Paolo Ardoino, also expressed his excitement about this decision to invest in Bitcoin and believes that it deepens the company's culture beyond the financial considerations: "We are not just investing in Bitcoin:

Our investment in Bitcoin is not only a way to improve the performance of our portfolio, but it is also a way to align ourselves with a transformative technology that has the potential to reshape the way we do business and the way we live.

Tether has cut 90% of its bank deposits in Q1 2023, shrinking from $5.3 billion to $481 million since the U.S. banking turmoil, and has instead increased its holdings of U.S. Treasuries, which as of Q1, Tether has over $53 billion in Treasuries.

Tether is afraid of bank thunder! USDT Q1 reserves slashed 90% of bank deposits, U.S. debt broke 53 billion magnesium