Enhancing Bitcoin Trading Strategies with Fibonacci Levels

-

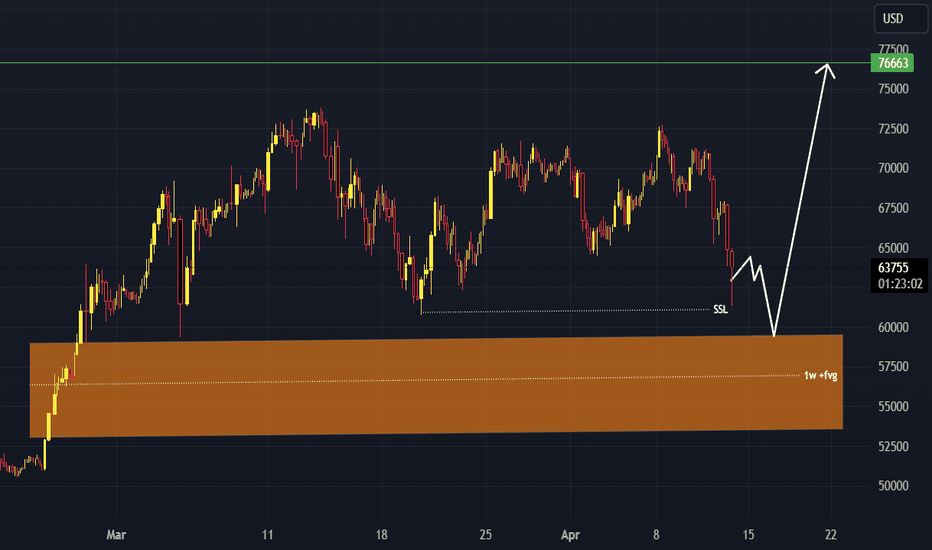

Trading Plan: Long Position Entry..! 1. Market Situation: - The market is currently moving towards the 1w +fvg (insert specific market or asset). - There is an expectation for price action to reach the 4h fvg (four-hour Fibonacci retracement level). 2. Expected Scenario: - A potential rejection is anticipated at the 4h fvg level. 3. Response Strategy: - If the anticipated rejection takes place, attention will be paid to the formation of a 4h +fvg (four-hour Fibonacci retracement level) as a potential reversal signal. 4. Entry Criteria: - After confirmation of the 4h +fvg formation following the rejection at the 4h fvg level, consideration will be given to entering a long position. 5. Risk Management: - Implement a stop-loss order below the recent swing low or a predetermined support level to manage potential losses. - Determine position size based on risk tolerance and account size. 6. Monitoring: - Continuously observe price action and reassess the trade thesis based on new market developments. 7. Exit Strategy: - Set take-profit levels according to key resistance levels or profit targets derived from technical analysis. Conclusion: This trading plan details the steps to leverage expected price movements, highlighting the importance of risk management and trade execution guided by technical analysis signals. --- If you find this approach favorable, kindly support my efforts. Thank you.

-

Bitcoin traders are currently speculating on the potential for a major price shift before the upcoming halving event. Analysts and enthusiasts are closely monitoring the market dynamics, especially regarding a possible Bitcoin price retracement. Renowned crypto analyst Rekt Capital has conducted a detailed analysis of the current Bitcoin market situation. For more insights on Bitcoin, feel free to follow my updates and analysis.

-

The price of Bitcoin has dropped below $67,000, marking a significant decline in over a week. The crypto market experienced almost $900 million in liquidations, with a notable portion stemming from losses in leveraged positions. Stay updated on the latest developments by connecting with us.

-

Bitcoin miners are set to lose a staggering $10 billion due to the upcoming halving event. With rewards being slashed from 6.25 BTC to 3.125 BTC, the impact on miners is expected to be significant. Despite the potential loss, there is a prevailing long buy position in the market. It's advisable to wait and monitor the situation closely, with hopes that the target will be achieved possibly within this week. Stay tuned for more updates! 🚀📈 #Bitcoin #Halving #Cryptocurrency #Mining

-

Bitcoin has resumed its upward trend following a minor dip amidst rising tensions between Israel and Iran. The cryptocurrency surged above $64,000 on Friday, recovering from a dip below $60,000, showcasing its ongoing volatility ahead of the upcoming halving event. As per CoinDesk data, Bitcoin's price hit $64,739.04 around 6:15 a.m. ET, marking a more than 5% increase from the previous 24 hours.

-

Bitcoin's price surged above $66,000 following its fourth halving event, with a 2% increase. Analysts anticipate this halving to positively impact Bitcoin's price due to high demand, particularly from international investment firms. Today, Bitcoin's price rose by 1.76% to $66,177.64, with a trading volume of $25.2 billion. Its market capitalization stands at $1.3 trillion, solidifying its position as the top digital currency by market value.