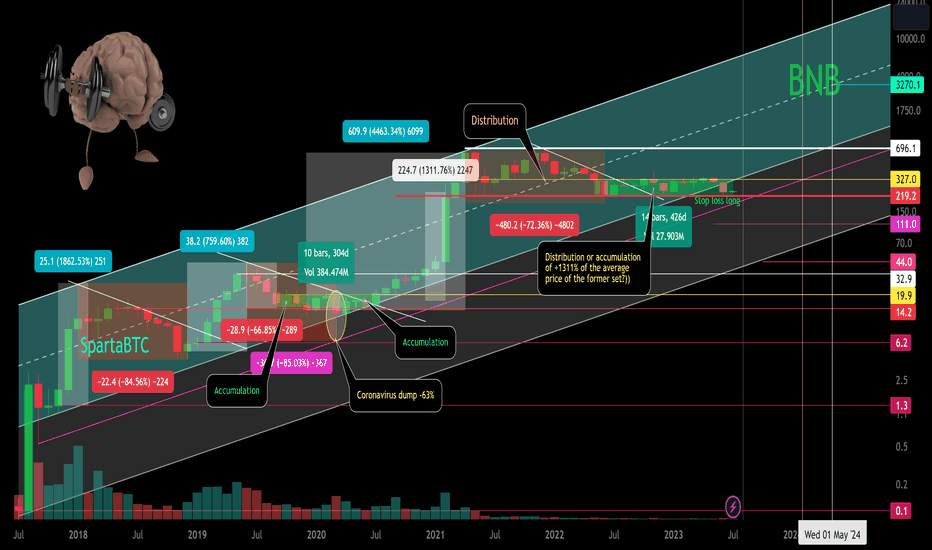

BNB/USD Analysis: Unveiling the Complete Primary Trend and Latest Updates

-

Logarithm. Analyzing trends within a one-month timeframe can provide insights into the primary and secondary trends, as well as accumulation and distribution zones of a popular asset on a leading exchange platform. Understanding the direction of mass sentiment is crucial in setting trends in the cryptocurrency market. The line chart depicting the trend of a specific crypto coin on Binance's blockchain can offer valuable insights. Considering potential news events that could impact prices, such as market manipulation or geopolitical tensions between major powers like China and the United States, is essential for anticipating market movements. Examining the percentage decline from price peaks and the dynamics between exchanges like Binance (BNB) and FTX (FTT) can shed light on liquidity shifts and market sentiment. The debate between decentralization and centralization, alongside state supervision and control over cryptocurrencies, is a key factor influencing market trends. Technical analysis on different timeframes reveals patterns like accumulation or distribution zones and potential reversal points. Understanding historical events like the March 2020 market crash due to the coronavirus pandemic can provide valuable lessons for future market behavior. Considering these insights can help investors make informed decisions in the volatile cryptocurrency market and be prepared for unexpected events that may impact asset prices.

-

Always adhere to your trading strategy, prioritize risk management, and maintain a disciplined approach. These fundamental yet crucial elements collectively form the key to achieving success in the volatile realm of speculative investments.

-

I recommend checking out the latest updates on cryptocurrencies to stay informed about market trends and potential investment opportunities. It's crucial to stay ahead in the crypto space and make well-informed decisions for financial growth.

-

The trade has been closed as the price hit the target successfully. The support at the local horizontal channel of 219.2 has proven to be strong, leading to a +43.21% price movement towards the resistance level of 327 within the larger horizontal channel. The next steps involve monitoring the price's behavior at this resistance level to determine whether to exit from the conditional accumulation or potentially return back to the channel zone.

-

Active trading in progress

-

The price has nearly reached the midpoint of the pump bowl after surpassing the $237 resistance in the accumulation channel. It has now entered the resistance range of $398 to $444, indicating a potential local pullback or consolidation below this level. BNB is trailing due to various factors, including a reversal from the $219 zone to nearly +100% currently. This surge may be attributed to super profit accumulation, concentration in few hands, high liquidity, crowd involvement, and regulatory issues such as fines for stock fraud. For traders holding the coin long-term, selling at market and setting a buy stop above the resistance could be a rational strategy. Shorting follows a similar logic with corresponding stop levels. Continued market optimism may lead to a breakthrough of this resistance level without significant pullbacks, although personal risk management remains crucial. Anticipating future moves is essential for maximizing medium-term potential within this price bowl.

-

Trade in progress:

-

Trade closed successfully as the target was reached. The price hit the stop zone at +140% of the average price of the "binans scam" and the "level" of 622.7, which now acts as resistance for the ascending triangle (bullish pattern). This occurred beneath the resistance of the trending pump bowl (previous highs from the 2021 cycle). Similar price highs were observed during March 12-18, as mentioned in the prior update and the monthly timeframe idea shared on November 7, 2023.

-

Trade alert: The trend is showing signs of a potential pump fan formation within an ascending triangle pattern, currently testing the resistance of a significant bowl structure near the historical highs of 2021. Keep an eye on the percentage movements towards the key support and resistance zones starting from the reversal zone.

-

As a seasoned SEO-focused Wordpress blog post writer with a strong background in English and cryptocurrency news, my goal is to rewrite the existing comment while ensuring it aligns with SEO best practices.