Bitcoin Tumbles Below $70.5K as Bearish Sentiment Takes Over

Panic Grips Cryptocurrency Market as Bitcoin Plunges

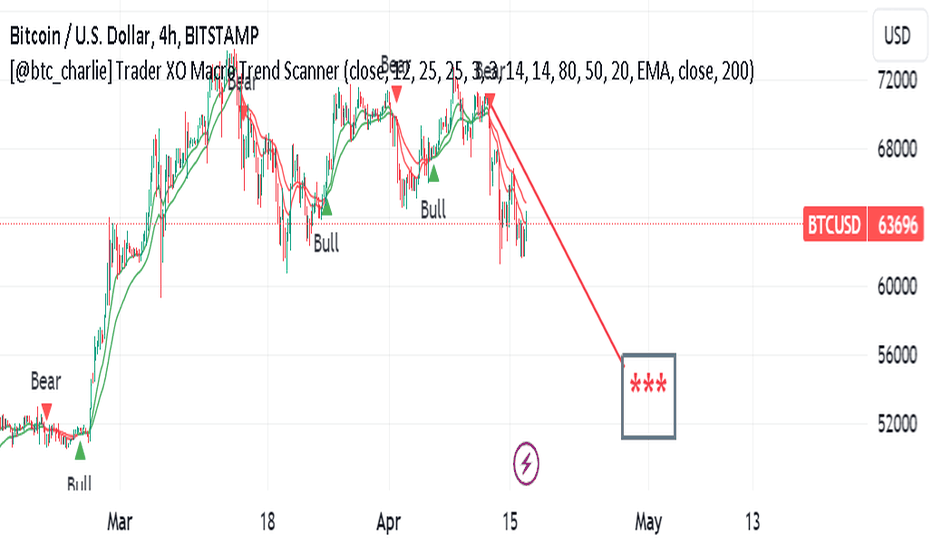

The cryptocurrency market faced turmoil this week as Bitcoin, the leading digital asset globally, dropped below the critical $70,500 mark. This sudden decline was accompanied by a concerning shift in a vital technical indicator, hinting at a potential bear market on the horizon.

The CoinDesk Bitcoin Trend Indicator (BTI)

The CoinDesk Bitcoin Trend Indicator (BTI), a well-respected measure of Bitcoin's price momentum, dealt a severe blow to investor confidence. After a period of bullish control since late February 2024, the BTI has now firmly entered bearish territory. This change denotes a significant shift in market sentiment, indicating a possible reversal of the earlier uptrend that drove Bitcoin to all-time highs this year.

Analysts' Caution

Despite the price drop and the BTI's bearish shift, some analysts advise against immediate panic. Interestingly, Bitcoin's trading volume remains relatively stable, suggesting sustained investor interest despite the sell-off. This ongoing activity implies that the market might be experiencing a robust correction phase rather than a total collapse.

Factors Contributing to Market Decline

Various factors are likely fueling the current downturn in the cryptocurrency market. Increasing regulatory worries continue to loom over the industry, with governmental bodies worldwide scrutinizing cryptocurrency transactions and exchanges. This escalated oversight is breeding uncertainty and dissuading some institutional investors from joining the market.

Geopolitical tensions and rising inflation are also impacting investor sentiment negatively. During times of traditional market volatility, investors tend to seek safer asset havens, often sidelining cryptocurrencies. Additionally, profit-taking by short-term investors who entered the market during the recent surge could be worsening the price fall.

Bitcoin Bulls Forewarned

The BTI's descent into bearish territory acts as a stark warning for Bitcoin enthusiasts. While the indicator doesn't promise a prolonged downturn, it signals a notable power shift between buyers and sellers. The upcoming period will be crucial in determining if Bitcoin can reverse this bearish trend.

Long-Term Outlook and Opportunities

Despite the current upheaval, some analysts see promise in Bitcoin's long-term prospects. They highlight the continuous evolution of blockchain technology and the potential for wider institutional acceptance as reasons for optimism. These supporters argue that the current decline offers a buying chance for investors with a long-term perspective, enabling them to accumulate Bitcoin at a discounted rate.

Future Uncertainty

The upcoming weeks and months will test the resilience of the entire cryptocurrency market. Bitcoin, as the industry's flagship, will be closely monitored as it navigates these turbulent times. Whether Bitcoin can withstand the challenges and emerge stronger or succumb to bear market pressures remains to be witnessed. One thing is sure: the cryptocurrency market is in for a turbulent journey.