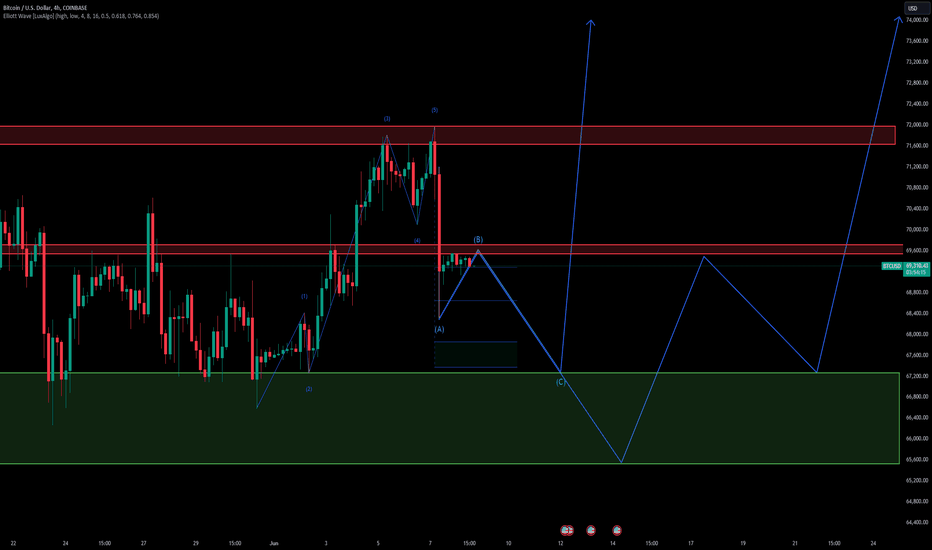

Bitcoin Price Prediction: Will BTC Retest Support at $67,000?

-

After the successful completion of the 5th Elliott Wave and a subsequent quick drop from the 72k resistance level, I anticipate the pattern to persist, ultimately finishing the final c wave supported at 67k. Should this support be breached, I foresee a retracement towards the subsequent support level at 65k, followed by a robust bounce back.

-

I do not actively trade Bitcoin (BTC) but rather hold spot positions. My altcoin trading strategy is based on Bitcoin's price action (PA). Currently, I have about 25% of my altcoin portfolio stabled as I anticipate a BTC retest of 67k, which could impact altcoin prices. Once Bitcoin completes a strong c wave above 71k, I plan to deploy these stabled funds into the market.

-

Also, please feel free to share your thoughts or provide alternative viewpoints. Thank you.

-

Trade alert: Trading volume has significantly increased, pushing the price towards the 67k support level ahead of the FOMC. The momentum remains uncertain, with the possibility of a retest of resistance or a potential move lower. The 4-hour RSI is currently oversold at 30, while the daily RSI is dipping below 50, indicating bearish sentiment in the market. Altcoins have experienced a sharp decline, with total3 retracing back to levels last seen on October 23. Monitoring the 1-day RSI is crucial at this point. A strong bounce from the 67k support level, followed by a rally towards 69k and potentially 72k, would signal a bullish reversal.