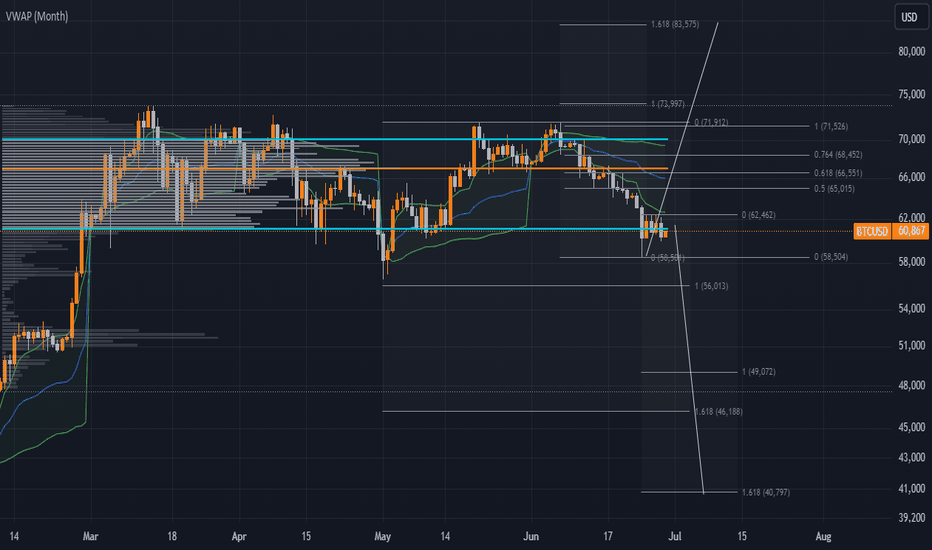

Price Levels:

The current price of Bitcoin is around $60,830.

VWAP Levels:

The VWAP (Volume Weighted Average Price) for the month is shown with three lines:

Fib Retracement Levels:

The significant Fibonacci retracement levels are marked, with key levels at:

- 0.236 (62,462)

- 0.382 (58,504)

- 0.5 (56,013)

- 0.618 (53,522)

- 0.764 (50,058)

- 1.618 (40,797)

Volume Profile:

The volume profile is shown, indicating high trading activity around certain price levels, especially between $60,000 and $70,000.

Trendlines and Projections:

A downward projection suggests possible lower targets.

Potential bullish target projection upwards, aiming towards $83,575 if a reversal occurs.

Moving Averages:

Short-term and long-term moving averages are included, suggesting a bearish trend as the current price is below the VWAP.

Analysis:

Current Trend:

The price is below the VWAP, indicating bearish sentiment in the short term.

The downward projection line suggests a potential further drop if the current support levels do not hold.

Support and Resistance:

Support: Around $58,504 (0.382 Fib level) and $56,013 (0.5 Fib level).

Resistance: The VWAP levels at $62,643, $66,021, and $69,398 act as resistance.

Price Projections:

If the price breaks below $58,504, it could drop further to the next support levels at $56,013 or even $53,522.

A bullish reversal above $62,462 could aim for the VWAP levels and possibly higher to $83,575.

Trading Strategy:

Short Positions: Enter if the price breaks below $58,504 with targets at $56,013 and $53,522.

Long Positions: Consider entering above $62,462 with targets at $66,021 and $69,398. Further confirmation is needed for a strong uptrend towards $83,575.

In summary:

Bitcoin is currently in a bearish trend with significant resistance levels to overcome. The support levels should be closely monitored for potential drops, while a breakout above the resistance could indicate a reversal.